3. Four main reasons causing macro data

underestimated

3.1 The practice of PPP projects

accelerating and growth rate of private investment falling

Since this year, the scale of PPP project

keeps expanding, yet accordingly the growth rate of private investment drops

evidently, with down to -1.2% in July, which is related to adjustment of

principal part of statistic caused by private investment going to PPP projects.

The scale of PPP is huge and its projects

speed up. There are 1,331 projects in two batches of PPP projects offered by

the National Development and Reform Commission, accounting for RMB3.5 trillion

of investment. Besides, 9,285 PPP projects provided by the Ministry of Finance

involve RMB10.6 trillion of investment. And the huge amount of investment

pushes up the constant rise of practice rate, with 35.1% in March going up to

48.4% in June.

The figure of private investment growth was

statistically lowered due to PPP projects which attract widely social capitals,

including private enterprises, state-owned enterprises and mixed ownership

enterprises. Among them, the private investment entering to the PPP projects

wasn’t counted into the statistical data. In H1 2016, the actual investment of

PPP projects reached to about RMB1.2 trillion, among which the investment of

private enterprises occupied 12%, the investment of mixed ownership enterprises

made up 51% (including state-owned enterprise + private enterprise, state-owned

enterprise + foreign enterprise, private enterprise + foreign enterprise). And

it’s anticipated that the total investment of private enterprises accounted for

45% to 50%. The construction cycle of capital investment usually lasts

relatively longer years, thus we correct the estimation by two terms of project

implementation---5 years and 10 years. After revised estimation, the data of

private investment growth in H1 2016 appeared to be 3.52%-3.60% and

3.17%-3.21%, respectively, which is obviously different from 2.82% released as

actual growth rate.

PPP projects lowering the growth rate of private

investment

|

The period of project implementation

|

The private investment of PPP in H1 2016

( billion RMB)

|

The private investment in H1

2016(trillion RMB)

|

The private investment in H1 2015(trillion

RMB)

|

The revised growth rate of private

investment in H1 2016

|

The actual growth rate

|

|

5 years

|

108-120

|

15.8797

|

15.4438

|

3.52-3.60%

|

2.82%

|

|

10 years

|

54-60

|

3.17-3.21%

|

Source:

Ministry of Finance, National Development and Reform Commission, Founder

Securities

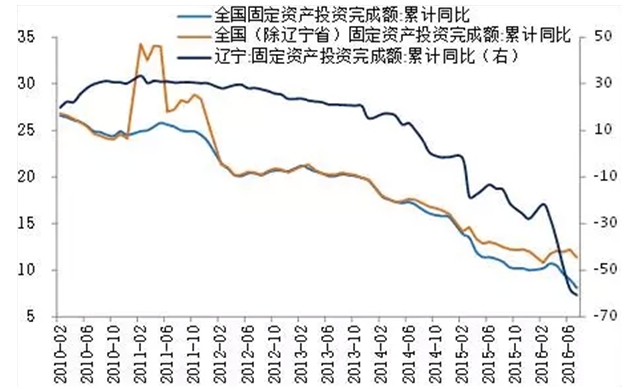

3.2 Liaoning province squeezing the false

statistic, lowering state growth rate of fixed-asset investment

The growth rate of social fixed-asset

investment falls remarkably in 2016, with the accumulative growth rate up by

8.1% YoY in the first 7 months this year, 0.9 percentage point lower than that

in H1 2016, and the growth rate in July up by 3.9% YoY,3.5 percentage points

lower than that in June.

To some extent, current data of fixed-asset

investment is disturbed by the statistics made by some local governments, such

as Liaoning province.

Since the financial crisis in 2008, Liaoning’s

fixed-asset investment growth rate even reached to 60% at one point. However,

this data began to fall sharply after the inspection team from central

government, in 2015, found that the three provinces in northeast China (Liaoning

province, Jilin province and Heilongjiang province) made some tricks on

statistics. This July, the accumulative growth rate of fixed-asset investment

in Liaoning province was -60.70% YoY, 2.6 percentage points lower than that in

June.

Stripping out the effect of Liaoning

province, there are signs of stability for the fixed-asset investment data this

year under the drive of real estate industry and PPP projects. The growth rate

of nationwide fixed-asset investment in Q2 2016 (removing the effect of

Liaoning province) appeared to be stable, with accumulative growth rate YoY in

the first half of 2016 going to 12.20%, 0.13 percentage point more than that in

the first 4 months. If Liaoning province is calculated, that figure in June

would be 1.5 percentage points lower than that in April, showing a relatively

high fluctuation in Q2.

Except Liaoning province, the growth rate

of fixed-asset investment in other provinces this year gets rebound to some

extent due to the stimulation of fiscal policy. From Feb. to July in 2016, the

growth rate of nationwide fixed-asset investment declined by 2.1 percentage

points, while that in Liaoning province was as highly as 39 percentage points.

In the same period, that figure was up by 2.1 percentage points in Chongqing,

up by 0.9 percentage point in Guangdong province, and down by 0.1, 0.2 and 0.6

percentage point in Shandong province, Hubei province and Jiangxi province,

respectively, all of which are better than the average state level in growth

rate. This, again, proves the stable performance of nationwide fixed-asset

investment recently, after eliminating the effect of Liaoning province.

Negative growth of statistic in

Liaoning province, lowering state growth rate of fixed-asset investment

Nationwide fixed-asset investment:

accumulative comparison YoY

Nationwide (except

Liaoning province) fixed-asset investment: accumulative comparison YoY

Liaoning: fixed-asset investment:

accumulative comparison YoY (on the right)

Source: Wind, Founder Securities

3.3 Local

government bonds issued to replace outstanding debt putting down the data of

medium and long term loans for enterprises

Local government bonds issued to replace

outstanding debt lower the data of medium and long term loans for enterprises.

In July, new loan increment of RMB reached to RMB463.6 billion, RMB1.01

trillion less increase YoY. The finance credit is totally supported by

individual housing loans, with the loans for household sector increased by

RMB457.5 billion, that for non-financial enterprises and government

organizations decreased by RMB2.6 billion.

According to the budget report of ministry

of finance, the local government bonds issued to replace outstanding debts due

in 2016 reach about RMB5 trillion, much more than RMB3.8 trillion in 2015. Data

from ministry of finance showed that up to the end of July, the local

government bonds issued this year was RMB3.971 trillion, with new bonds

RMB1.0084 trillion and replacement bonds RMB2.9626 trillion. What’s more, the

majority of local government replacement bonds were replaced by enterprises’

medium and long term loans, which made the data of enterprises’ medium and long

term loans this year distorted and underestimated.

3.4 Consumption in emerging industries exuberating

and there are many missing points in statistic

As the increase of per capita income,

resident consumption structure keeps advancing. H1 2016 witnessed the

continuous progress in such industries as tourism, aviation, entertainment and

healthcare, though the whole economy went downward. Notably, the fixed-asset

investment of aviation industry enjoyed a rapid growth against the overall

trend. However, as these industries just occupy a small proportion of GDP and

the statistic approach for service sector is not as good as that for

manufacture sector, there exists many missing data in service sector.

Though affected by the downward economy and

depreciation of RMB, China’s tourism stayed a favorable growth in H1 2016, with

the number of accumulative domestic tour people up by 10.47% YoY, that of accumulative

inbound tour people up by 3.8% YoY, and that of accumulative outbound tour

people up by 4.3% YoY. Driven by tourism industry, the volume of passengers

transport through civil aviation kept high growth, with the growth rate going

up by more than 10% YoY since April.

Tourism industry keeping positive growth

Source: National Tourism Administration,

Founder Securities

Volume of passengers transport

through civil aviation keeping high growth

(%)

The volume of passengers transport

through civil aviation, monthly figure YoY

Source: Wind, Founder Securities

4. Conclusion: the economy situation

appearing to be L-shape, and 5% of growth currently better than 8% of growth in

the past

1) The real situation of economy appears to

be L-shape.

2) Several proofs for L-shape economy

3) Four major reasons that cause the macro

data underestimated

4) L-shape economy makes big influences on

stock market, bond market and the commodity price.

5) The government carried out a neutral and

prudent monetary policy recently due to sharp rise of real estate prices,

de-leverage plan and expectation of raising interest rate by FED.

6) Potential risk: The expectation of

raising interest rate by FED is more possible, causing the depreciation of

exchange rate, the pressure of capital outflow, and the impact on China’s

financial market, particularly, on the real estate industry. And the minor

cycle of real estate rise may go to the end due to the policy for restraining

asset price bubble as well as the completion of release of stage demand. Besides,

the price rebound of coal, iron and steel may bring about the recovery

production, thus changing the relation between supply and demand. What’s more,

a new round of clearance and regulation might be introduced as PPP get out of

control.

*The

article is edited and translated by CCM. The original one comes from Laohucaijing.com.

About CCM:

CCM is the leading market intelligence

provider for China’s agriculture, chemicals, food & ingredients and life

science markets. Founded in 2001, CCM offers a range of data and content solutions, from price

and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a

brand of Kcomber Inc.

For

more information about CCM, please visit www.cnchemicals.com or

get in touch with us directly by emailing econtact@cnchemicals.com or

calling +86-20-37616606.